Who (or What) Is Satoshi Nakamoto?

Exploring the Weirdest, Richest, Most Suspicious Disappearance in Tech History

TL;DR: A man (or myth) launched a currency, became worth $117B, and then disappeared without a trace. Totally normal.

Act I: The Legend

In the beginning, there was a PDF.

Just nine pages long.

Released on Halloween 2008.

Titled — in possibly the least clickbaity way imaginable —

“Bitcoin: A Peer-to-Peer Electronic Cash System.”

It was posted to a cryptography mailing list by a user named Satoshi Nakamoto, whose identity, even now, could be anyone from a libertarian maths professor to a Japanese janitor to a machine learning project run by DARPA.

No one knew who he was. But the idea was wild.

An internet currency not controlled by governments.

No banks. No borders.

Just math.

And somehow… it worked.

The Timeline of a Ghost

Let’s lay it out:

- Oct 2008: Satoshi drops the whitepaper.

- Jan 2009: The Bitcoin network goes live.

- 2009–2010: He posts regularly on crypto forums and emails. Friendly. Smart. Kind of formal. British spelling.

- 2010: He hands off the project to others.

- 2011: Emails a developer: “I’ve moved on to other things.”

- Then?

Gone.

Early 2009: He mines the first block — the Genesis Block — containing a timestamp and a message:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

No more posts.

No transactions from his address.

No notes. No leaks. No Vegas sightings.

Not even a comeback podcast appearance with Joe Rogan.

Just… silence.

That Alone Is Weird

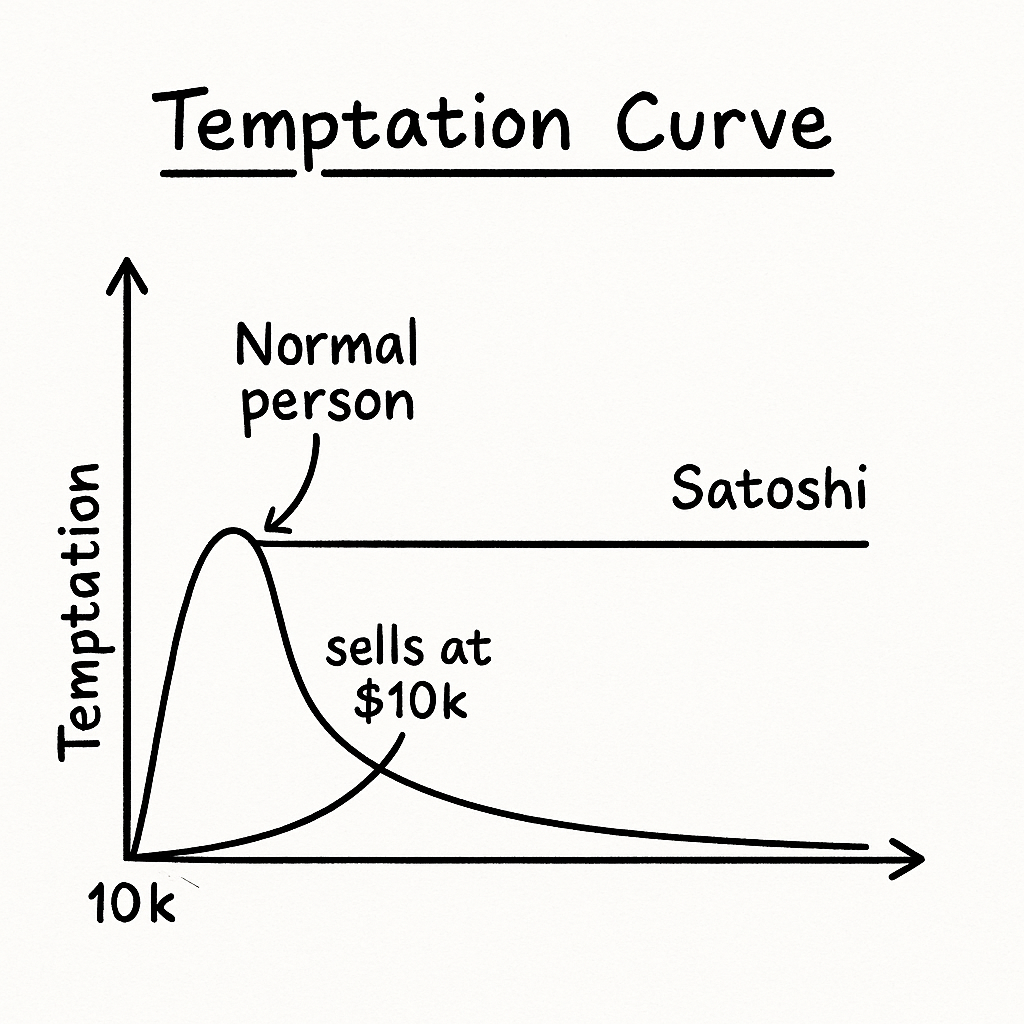

Imagine inventing the best-performing asset in human history, watching it balloon to trillions in value… and not even checking back in.

No victory lap.

No “told you so.”

No autobiography.

Not even a cheeky transaction to move 0.01 BTC and watch the world panic.

It’s like the Steve Jobs of money just rage-quit the internet.

At today’s price, Satoshi’s wallets are worth over $117 billion.

That's more than Buffett. More than Gates. More than Musk, depending on the month.

And it hasn’t moved. Not once.

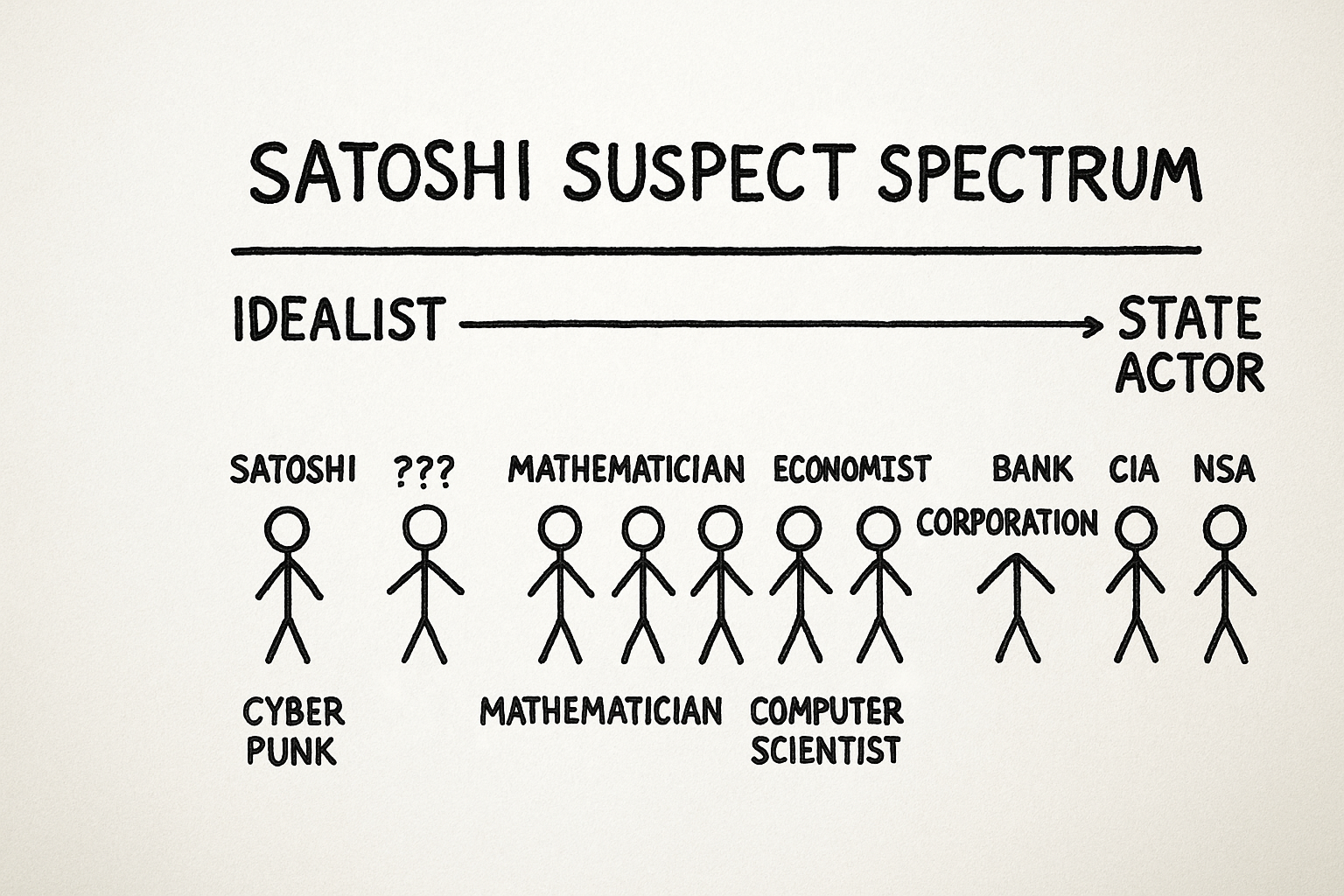

Satoshi Is a Rorschach Test

Since that final message, Satoshi has become less of a person and more of a mirror.

People see in him whatever they need to see:

- The benevolent genius who saved us from fiat.

- The digital messiah who walked away from power.

- The spy who left a perfect trap.

- The whale behind every market crash.

- The myth holding the system together.

And the longer he stays silent, the bigger the myth becomes.

Act II: What It Would Take to Build Bitcoin

Let’s pretend it’s 2008.

You’re a lone genius with a burning desire to fix money.

You’re also:

- A cryptography expert

- A software engineer

- A distributed systems architect

- A behavioural economist

- A security researcher

- And apparently allergic to fame, error, and wealth

Your mission:

Build an unbreakable, trustless, fully decentralized currency.

One that no one can hack, no one can control, and everyone will trust.

Cool. So… good luck.

Let’s Get Real for a Second

Most software projects barely survive their own launch.

Apps crash. APIs break. Beta users break things in ways the developers didn’t even think were possible.

And that’s with full teams.

Bitcoin didn’t just launch.

It worked. Out of the gate. In the wild.

No funding. No visible team. No beta testers. No oversight.

It just… worked.

If you told me this was an indie app for tracking your gym reps, I’d be impressed.

But it’s money. The foundation of human civilization.

And it worked the first time.

A Checklist of What Satoshi Had to Nail

| 🔧 Category | 🧠 Skill Required |

|---|---|

| Cryptography | SHA-256, ECDSA, Merkle trees |

| Network Design | Peer-to-peer protocol development |

| Incentive Engineering | Game theory + economics |

| Software Architecture | Modular, secure, scalable code |

| Security | Threat modeling, attack prevention |

| Psychology | Community design, trust engineering |

| Comms | Clear, persuasive writing |

| Stealth | Remaining anonymous under pressure |

Now add:

- Code quality so good it still runs today

- Zero major hacks during the early fragile years

- No cryptographic mistakes

- No "oops" bugs in the incentives or mining logic

- A flawless exit from public view

All by one person?

The Launch Wasn't Just Smart, It Was Strategic

- The Genesis Block was time-stamped with a real newspaper headline.

- The 21 million cap balanced scarcity with mineability.

- The reward halving cycle was a masterstroke.

- The code itself was clean, modular, and extensible.

This wasn’t duct-taped together in a caffeine haze.

It was the kind of work you expect from a multi-year research project funded by a government or institution.

And then — just when it started to take off — he vanished.

Act III: The Possible Theories

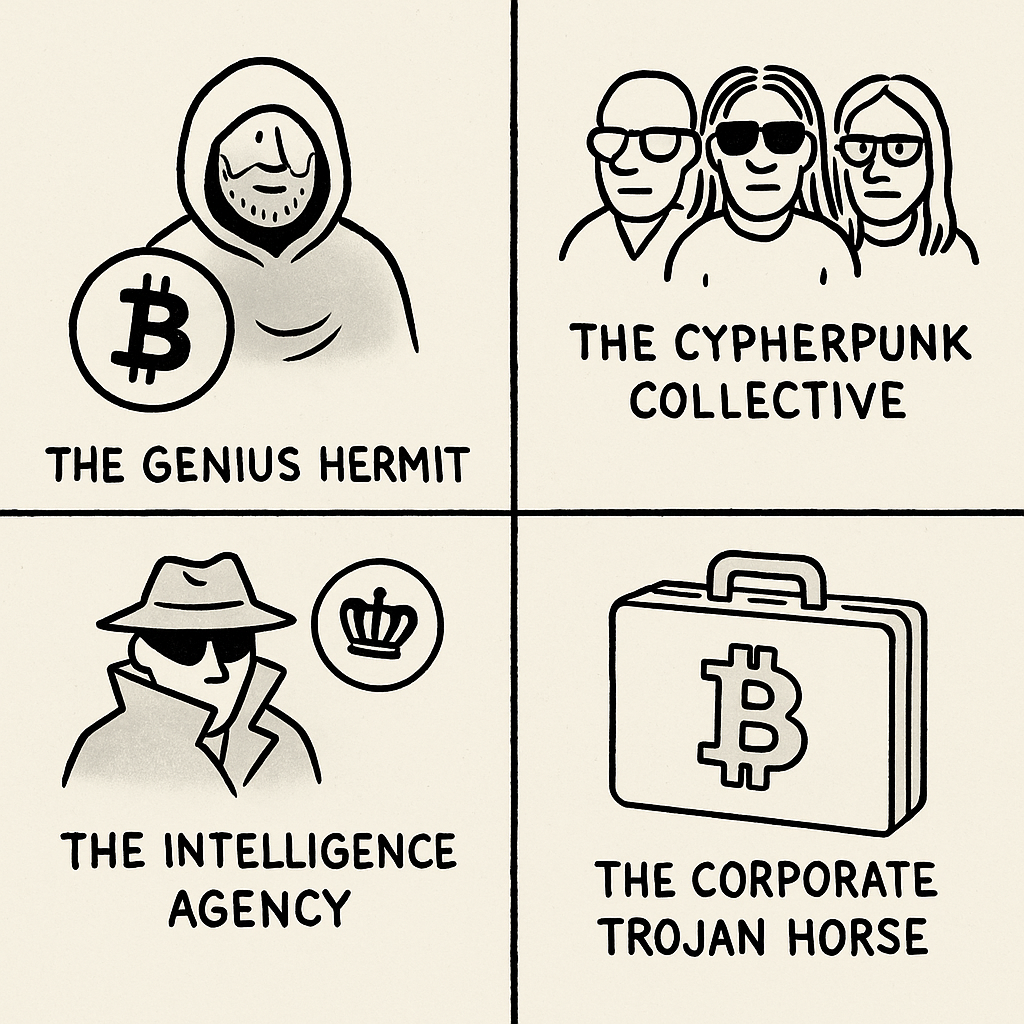

🧙♂️ 1. The Genius Hermit

The romantic version. A mysterious, brilliant polymath with a grudge against central banks.

Pros:

- Consistent writing voice

- Cypherpunk community already had geniuses

- Possible it really was one man

Cons:

- $117B says most humans would’ve cracked by now

🧑🤝🧑 2. The Cypherpunk Collective

A small, ideologically aligned crew of cryptographers and privacy nerds.

Pros:

- Finney, Szabo, Dai — all plausible suspects

- Shared effort explains polish and silence

Cons:

- Groups leak. Always.

🕵️♂️ 3. The Intelligence Agency

Bitcoin as a test. A honeypot. A backdoor economic weapon.

Pros:

- NSA/GCHQ/PLA all have capability

- Perfectly timed

- Could explain why the wallet doesn’t move

Cons:

- Why let it escape their control?

💼 4. The Corporate Trojan Horse

A high-volatility product disguised as rebellion.

Pros:

- Who benefits now? Institutions.

- Bitcoin is traceable. That’s great for power.

- Privacy coins are ignored or shut down.

Cons:

- Assumes decade-long narrative control.

- Might be too cynical. Or just cynical enough.

🧌 5. The Accidental God

Maybe he just got overwhelmed. Or disillusioned.

Pros:

- His tone was modest, thoughtful

- The clean exit could have been sincere

Cons:

- Absolute silence is still suspicious

Act IV: The Ghost Wallets

1.09 million BTC

$117 billion

Zero transactions

Not even a whisper.

📉 Why These Wallets Hold the Market Together

If they moves, trust collapses.

If they sell, the myth dies.

This isn’t money. It’s a deterrent.

Theories:

- Satoshi is dead → no key = no risk

- Satoshi is disciplined → monk-like restraint

- Satoshi is not a person → policy weapon

Act V: Why It Still Matters

Bitcoin works because Satoshi disappeared.

No founder = no attack vector.

No movement = no motive.

Myth Beats Math

Bitcoin runs on code.

But belief is the real engine.

A story so strong it’s worth $1.37 trillion.

The Power of Not Knowing

We don’t know if Bitcoin is:

- A gift

- A trap

- A test

- An accident

But we do know it’s real. And it’s here.

We didn’t escape the system.

We became it.

Bonus Act: What Would Happen If the Wallets Move?

If those wallets, Satoshi’s original stash of ~1.09 million BTC — ever moved, here’s what would unfold, layer by layer:

🧨 Immediate Reactions (Minutes to Hours)

🚨 Crypto Twitter explodes

- “BREAKING: Satoshi’s wallet just moved.”

- Hashtags like #SatoshiIsBack and #BitcoinApocalypse trend worldwide.

- Elon tweets a single eyeball emoji. It gets 6.9M likes.

💻 Blockchain explorers light up

- Chain analytics firms go into overdrive.

- Exchanges prepare to freeze suspicious deposits.

📉 Market Fallout (Within 24 Hours)

💰 Bitcoin price crashes. Hard.

- Instantly drops 20–40%.

- Leverage liquidations cascade across exchanges.

- Altcoins get dragged down in sympathy.

The sacred silence breaks. Trust becomes negotiable.

🧠 Narrative collapse

- “Is Bitcoin truly decentralised?”

- “Is Satoshi back? Was it ever safe?”

- “What does this mean for crypto’s future?”

🏛 Institutional Panic (Day 2–3)

🏦 ETFs and hedge funds pause

- BlackRock, Fidelity, Grayscale issue emergency statements.

- Inflows halt. Redemption clauses kick in.

📉 Public companies react

- Tesla’s BTC stash is scrutinised.

- MicroStrategy’s stock craters.

🕵️♂️ Media Frenzy (Week 1)

📺 Mainstream media floods in

- CNBC: “Satoshi Lives?”

- Fox News: “Digital Dollars or Digital Danger?”

- Reddit: Full chaos mode.

🎤 Theories go nuclear

- It’s not Satoshi — it’s the CIA.

- He faked his death.

- It’s always been BlackRock.

- Or aliens. Definitely aliens.

💻 Technical Fallout

🔐 Wallet migrations & key rotations

- Whales scatter funds into cold storage.

- Privacy coins spike in interest.

- DeFi platforms experience liquidity shock.

🧠 Psychological Fallout

🧍♂️ Disillusionment

- The origin myth fractures.

- Hardcore maxis split:

- “It’s a trick!”

- “It doesn’t matter.”

- “I’m out.”

🧪 Real decentralisation test

- Bitcoin without belief is just code.

- Does it hold up?

🔮 Longer-Term Outcomes (Weeks to Months)

- Coins move but aren’t sold:

→ Market slowly recovers. Myth becomes myth-plus-fear. - Coins hit exchanges:

→ Full market collapse. Global news cycle. Possible regulation spikes. - Coins are sold slowly, strategically:

→ Market wobbles, but adapts. Satoshi becomes... just a person. - Coins are burned publicly:

→ New religion forms. “Proof of selfless creator.” Price goes up.

Final Thought

Those wallets are the psychological anchor of an entire financial ecosystem.

If they ever move, the story changes forever.

And Bitcoin has always been a story first and a system second.

Member discussion